Best Moving Average For 4 Hour Chart

While the best way to determine the trend is to put some eyeballs onto the chart that is still a subjective judgement and can sometimes be open to interpretation. For example you might look for a strong upward price move on the daily and 4-hour time frame wait for a period of retracement on the 1-hour chart and then enter a long position when the EMA 5 crosses upwards through the EMA 20 on this same time frame when the longer term trend prevails.

Popular Moving Averages And How To Use Them

Anything from 20 period until 50.

Best moving average for 4 hour chart. Above 50 with 100 and 200 as popular long-term moving averages. If you are an intraday trader you will most likely operate on charts smaller than the hourly one. For instance you can select 50-day MA and it will show you the average price for the past 50 days.

One of the best ways is to use multiple time frames. When it comes to moving averages here are a few common examples. The 34 MA is below the 55 MA and stays below the 55 MA.

Typically anything from 5 period to the 15 period. For a more objective method moving. In the example below we see a clear-as-day pin bar buy signal from support in the SP500 circled in the chart below.

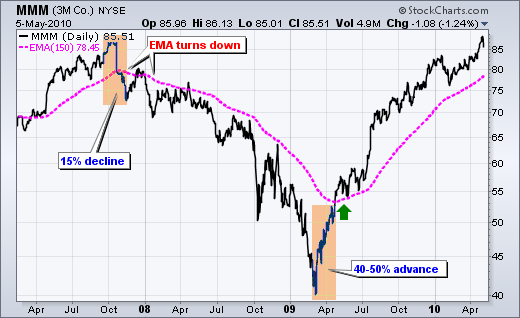

If you are wondering about the best time frame for a 200 EMA trading strategy the answer is 4 hour chart. For it to spot reversals you need multiple moving averages to change direction completely by pulling themselves up or down behind a long term MA. Often there is important news that creates volatility.

The worst performing moving average. An example of a downtrend with the moving averages is shown on the following chart. AudUsd is also more active during the night.

EURAUD 4h A strong downtrend in 2016 provided several great opportunities for this strategy. The best moving average for day traders and short term traders will be the one that fits their own intraday time frame and the average time they want to hold a trade for scalping or day trading whether it is 1-minute 5-minute 15-minute or an hour there is no universal answer a trader needs to see what works best for them moving. The most popular simple moving averages include the 10 20 50 100 and 200.

The MAs are sloping downwards for most of the time as they trail behind the trend. Most equity markets are open between 8 and 9 hours each day and as such the four-hour chart might take on less importance. Downward Gold Trend - Bearish Gold Trend.

For the same reasons as UsdJpy using a 15-period average on an AudUsd hourly chart is feasible. You must risk a fraction of your equity on each trade to survive the inherent drawdowns. Traders often use the smaller faster moving averages as entry triggers and the longer slower moving.

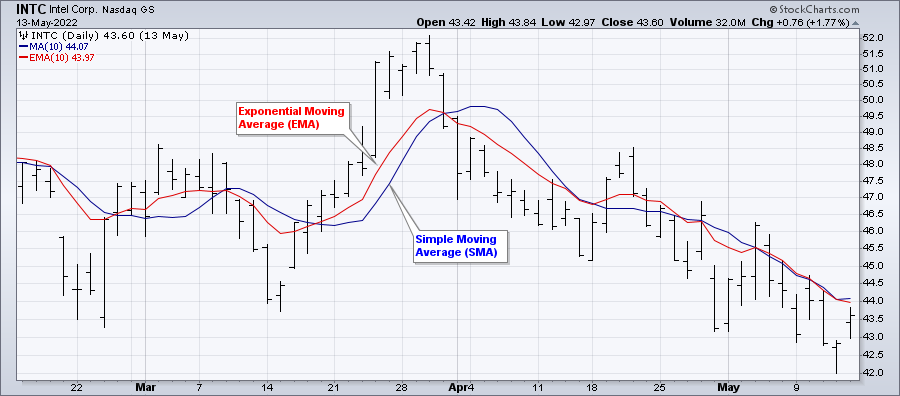

Getting the best moving average for 4 hour chart shouldnt be a standalone strategy the trader must first run a proper market analysis on the pair then the 4 hour chart moving average can be a secondary option for trading. As you can see from the table the best moving average for a 520 day crossover was the exponential moving average EMA which gave a compounded annualised return of 36 and a maximum drawdown of -34 resulting in a CARMDD of 011. Place the 200 EMA on the daily chart and identify the trend direction.

First the trend will change on 1 minute then 5 minute charts then 10 then 15 minute charts and so on until the major trend on large scale charts changes. Wait for the 30 period moving average yellow to cross below the 60 period moving average blue Ensure that two moving averages are sloping down The 30 period moving average yellow is sloped down at an angle of 20 degrees or steeper No exact measurement is necessary here but a subjective estimate is good enough Look for a red arrow to appear on the RSI indicator after the 3 criterions for the moving. All charts courtesy of TradingView.

Best Moving Average for 1 Hour Gold Trading Chart - Best Moving Average for 1 Minute Chart Gold - Best Moving Average for 15 Min Chart Gold. Day 10 market price 64. Or you can select 50-minutes MA and it will show you the average price for the past 50 minutes.

In the StockCharts DecisionPoint documentation it says that the weekly 17EMA and 43EMA and monthly charts 6EMA and 10EMA can be used to show long-term trends but in the webinar Erin said that they use only the daily chart. The sum of the markets price over these 10 days is 554 and since there are 10 periods the 10 day simple moving average 554. You should be able to trade about 60 markets from these 5 sectors.

4 Hour Forex Trend Following Strategy With Moving Average. If the Moving Average is moving down then the trend is downwards and the gold signal generated is a sell signal. One of those ways is by use of the 1-hour or 4-hour charts to look for a signal a few hours or even days later to re-enter in the direction of the original daily chart signal that you missed.

Therefore you will need the daily chart the 4-hour chart and the 1-hour chart. 200 Period Exponential Moving Average MAAngle with. Using EMA as a filter.

The 4-hour chart plays a special role in the FX market. If youre someone who holds a day job trading the 4 hour and daily charts would be suitable. Keep your risk to no more than 1 of your trading account.

Moving averages can be applied on any time frame provided the trader knows how to apply them for market entries. A trader may take a 520 or a 1020 hour crossover or cross under for a very short term trade over hours or days. Heres an example of the SP 500s 200 day moving average.

The indicator shows the average price for the selected number of days and creates a line to show you where the price is actually moving. The best Ema in 1 hour chart for Audusd. The 200 EMA trading strategy is a multi-timeframe Forex strategy.

Heres a great versatile trading strategy that can be used to buy and sell trend reversals or to buy dips in an established up trend or sell rallies in an established down trend.

Moving Averages Simple And Exponential Chartschool

How To Trade With The Exponential Moving Average Strategy

Pip Retracement Forextrading Trading Charts Technical Trading Chart

Best Trading Strategies If The Ema 50 Crosses 200 Ema Updated 2021

Our Very Profitable 4 Hour Chart Trend Following Strategy Fx Trading Revolution Your Free Independent Forex Source

4 Effective Trading Indicators Every Trader Should Know

What Is The Best Moving Average And The Best Indicator Setting For Your Trading

Simple Moving Average Sma Explained Babypips Com

Moving Averages Simple And Exponential Chartschool

Popular Moving Averages And How To Use Them

A Guide To Multiple Time Frame Analysis

Simple Moving Average Sma Explained Babypips Com

Exponential Moving Average 5 Simple Trading Strategies

Our Very Profitable 4 Hour Chart Trend Following Strategy Fx Trading Revolution Your Free Independent Forex Source

Best Moving Average Trading Strategies For Cryptocurrencies

Best Trading Strategies If The Ema 50 Crosses 200 Ema Updated 2021

How To Trade With The Exponential Moving Average Strategy

Popular Moving Averages And How To Use Them

Post a Comment for "Best Moving Average For 4 Hour Chart"